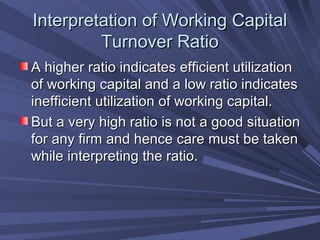

working capital turnover ratio interpretation

It is also an activity ratio. Significance and Interpretation.

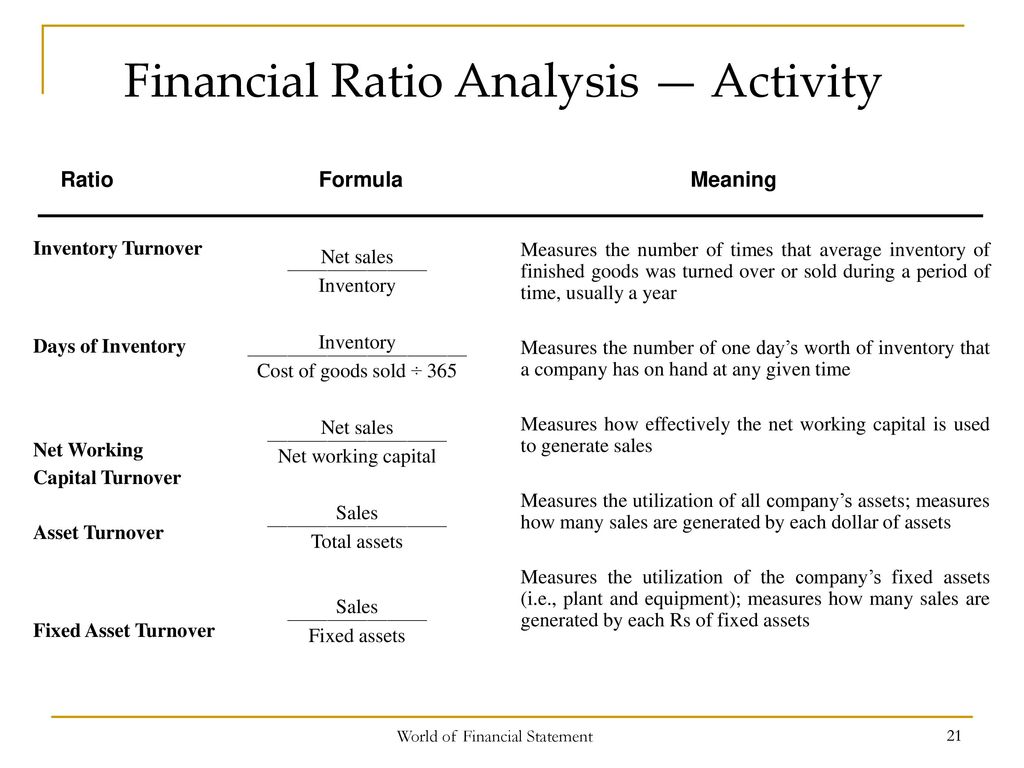

Financial Statements Ppt Download

High Working Capital Turnover Ratio indicates the company is very efficiently using the current assets and liabilities to support its sales.

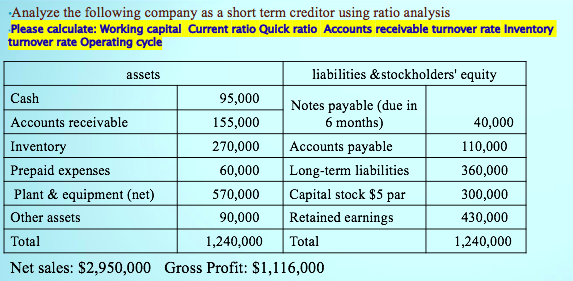

. WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover. The working capital turnover ratio will be 1200000200000 6. 100000 40000.

240000 140000 280000 1000002. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. For example the working capital turnover ratio formula does not take into account unsatisfied employees or periods of recession both of which can influence a businesss.

It means each dollar invested in. The reciprocal of the ratio will become 025 that is the reciprocal of 41 is 14. The formula to measure the working capital turnover ratio is as follows.

It is a measurement of the efficiency with which the Working Capital is. In some ways therefore a wildly fluctuating fixed asset turnover ratio is a measure of high risk that a company. 500K to produce the same amount of sales.

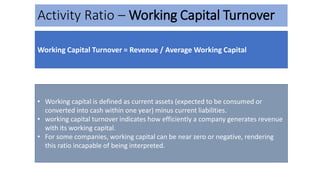

WC Turnover Ratio Revenue Average Working Capital. This is why this ratio is also called Working Capital Turnover Ratio as it. First lets calculate the average working capital.

The working capital turnover ratio of Exide company is 214. It means each dollar invested in working capital has contributed 214 towards total sales revenue. Putting the values in the formula of working capital turnover ratio we get.

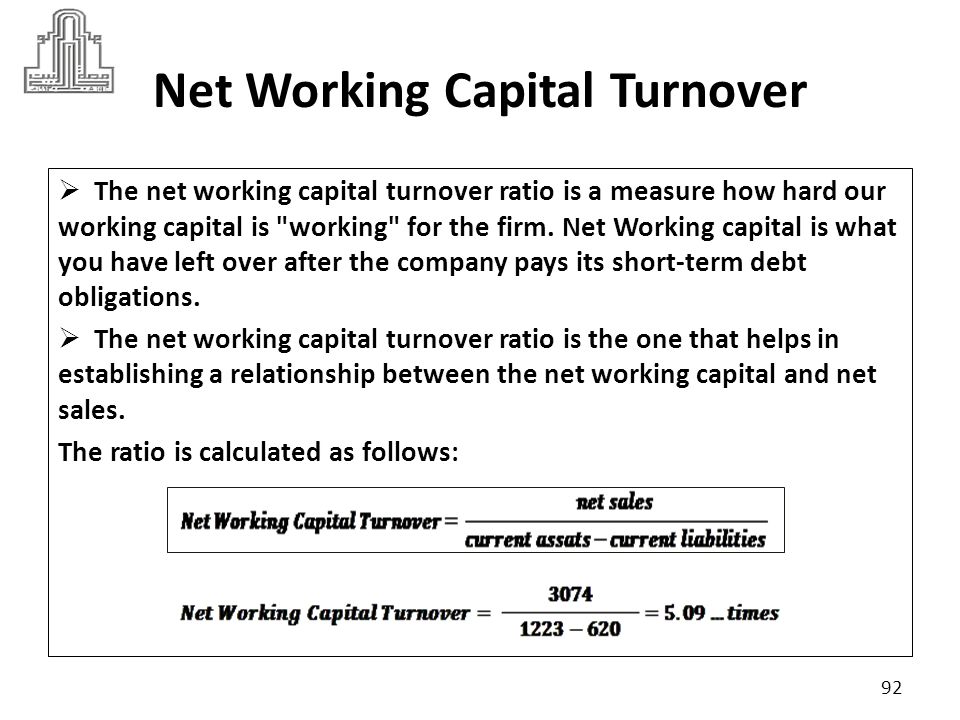

The Working Capital Turnover Ratio refers to the ratio of the Net sales and the average Working Capital of the company. The working capital turnover ratio of Exide company is 214. We calculate it by dividing revenue.

Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. The working capital turnover ratio is an accounting ratio that determines how effectively a business utilises its working capital to generate revenue. Working capital is current assets minus current liabilities.

Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales. Now working capital Current assets Current liabilities. It also includes ratio.

Net Working Capital Turnover Sales Net Current Assets. Average working capital. A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working.

Is generating Sales of 1M with a working capital of 200K but it is taking Villian Corp. Now that Jen has the income statement and balance sheet she finds the following lines items and amounts. Working Capital Turnover Ratio Calculation and Analysis.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and. All else being the same Superpower Inc. Working capital can be calculated by.

Solved Analyze The Following Company As A Short Term Chegg Com

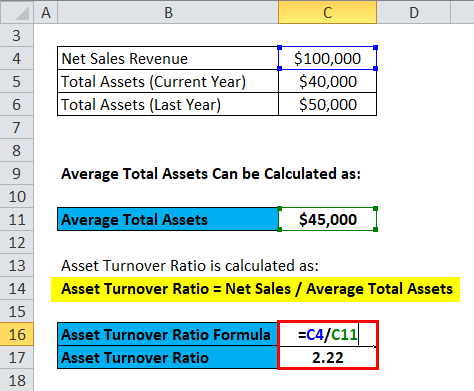

Asset Turnover Ratio Formula Calculator Excel Template

Activity Ratio Formula And Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

What Is Capital Turnover Basics Definition Sendpulse

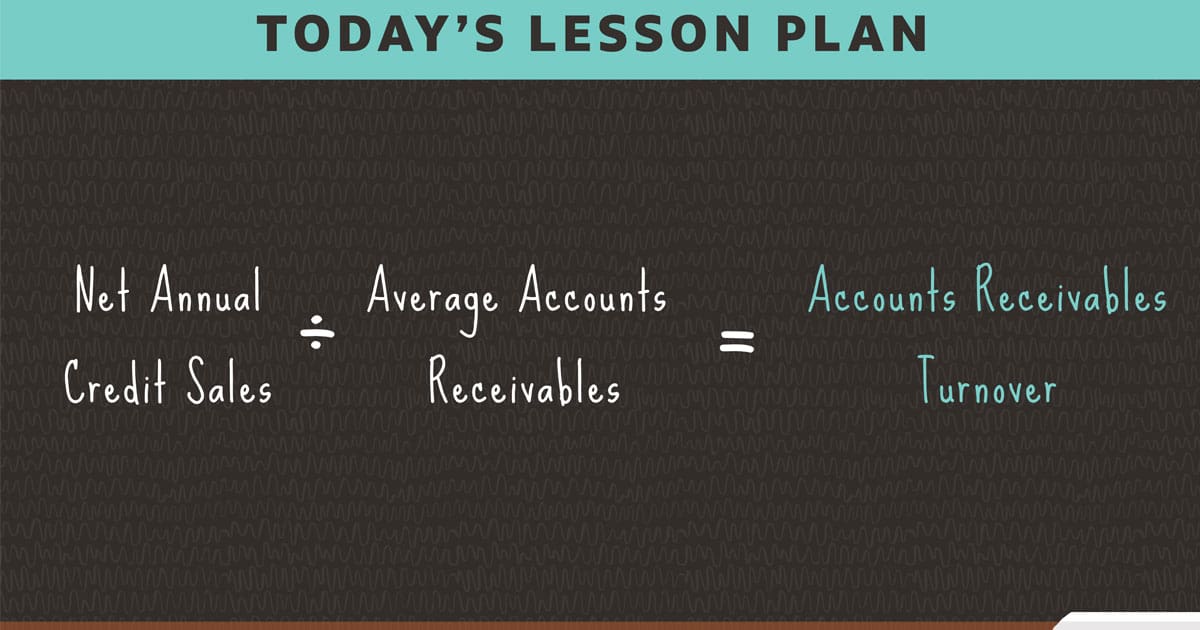

Accounts Receivable Turnover Ratio Definition Formula Examples Netsuite

Understanding Ratio Analysis Tutorial

19 Turnover Ratio Analysis Templates Google Docs Word Pages Pdf Free Premium Templates

Working Capital Turnover Ratio Meaning Formula Calculation

Negative Working Capital Formula And Calculation

Working Capital Turnover Ratio Meaning Formula Interpretation

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

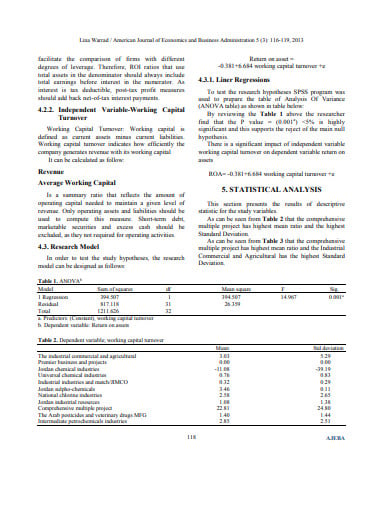

Comparative Analysis Of Working Capital Turnover Ratio Of Selected Download Scientific Diagram

Working Capital Turnover Ratio Double Entry Bookkeeping

Working Capital Turnover Ratio Meaning Formula Calculation

Chapter 4 Ratio Analysis Diagram Quizlet

Financial Ratio Analysis Working Capital Turnover Ratio Mudranka